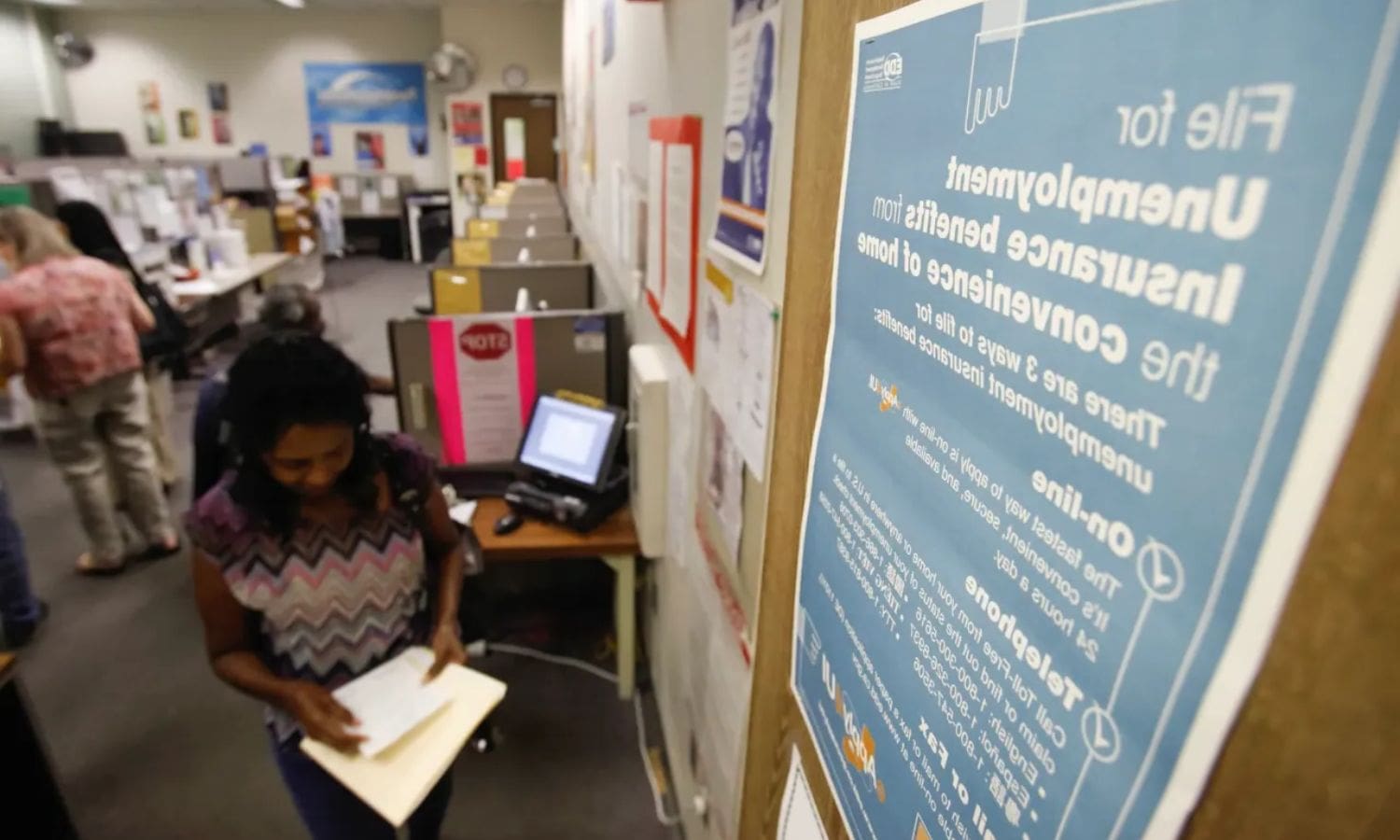

California Multibillion Dollar Quandary: The California Employment Development Department (EDD) finds itself grappling with the repercussions of mismanagement during the COVID-19 pandemic.

A recent investigation by Calmatters has shed light on the EDD’s failure to address red flags, implement necessary reforms, and combat online fraud prior to the crisis.

The consequences have been twofold – legitimate unemployment claims mishandled and billions of dollars distributed to fraudsters.

The dual crisis of massive fraud losses and financial instability for genuine claimants, highlighting the urgent need for reform.

Key Takeaways Of California Multibillion Dollar Quandary

- EDD’s mismanagement during the pandemic led to mishandling of legitimate unemployment claims.

- Billions of dollars were distributed to fraudsters due to EDD’s failure to address red flags and implement reforms.

- The dual crisis of massive fraud losses and financial instability highlights deep-rooted issues within the EDD.

- Urgent reforms and improved management are necessary to address the EDD’s lingering challenges and protect the state’s ability to support its unemployed residents.

EDD’s Mismanagement Fallout: A Dual Crisis Unveiled During the Pandemic

The mismanagement of the California Employment Development Department (EDD) during the COVID-19 pandemic has resulted in a dual crisis, revealing significant fallout for both legitimate claimants and the department itself.

A CalMatters investigation has shed light on the EDD’s failure to address red flags, implement reforms, and tackle online fraud before the pandemic. As a result, billions of dollars were distributed to fraudsters, while a multitude of legitimate unemployment claims were mishandled. This mismanagement has led to a massive crisis, with the EDD suffering from substantial fraud losses and financial instability for legitimate claimants.

The department’s inability to effectively manage the influx of claims and detect fraudulent activity has left many individuals struggling to receive the benefits they are entitled to, further exacerbating the economic hardships caused by the pandemic. The fallout from the EDD’s mismanagement is a clear indication of the need for immediate reforms and improved oversight within the department.

Federal Loan and Debt: EDD’s Financial Struggles Post-Pandemic

EDD’s financial struggles post-pandemic include a significant burden of federal loans and mounting debt. Here are four key points that highlight the severity of the situation:

- Borrowing to Cover Unemployment Benefits: As a result of the unprecedented surge in unemployment claims during the COVID-19 pandemic, the EDD had to borrow a staggering $18 billion from the federal government to fulfill its obligation of providing unemployment benefits to millions of Californians.

- Increased Debt Service: The EDD’s mounting debt has led to a substantial increase in debt service costs, further straining the department’s financial resources. These costs include interest payments on the borrowed funds, which will have to be repaid over time.

- Impact on Employers: The EDD’s financial struggles have significant implications for employers in California. The increasing debt and subsequent need to repay the federal loans could result in higher payroll taxes for businesses, potentially hampering their ability to recover from the economic downturn caused by the pandemic.

- Long-Term Consequences: The EDD’s financial challenges extend beyond the immediate post-pandemic period. The accumulation of debt and the need to repay it could have long-term consequences for the department’s ability to adequately fund unemployment benefits and maintain financial stability in the future.

These financial struggles highlight the urgent need for the EDD to implement effective reforms and address the underlying issues that have contributed to this dire situation. Failure to do so could have lasting ramifications for both the department and the Californians who rely on it for vital support during times of unemployment.

Unemployment Insurance Fund’s (UIF) Ongoing Challenges

The ongoing challenges faced by the Unemployment Insurance Fund (UIF) include managing the substantial burden of federal loans and addressing the mounting debt caused by the mismanagement of the California Employment Development Department (EDD) during the COVID-19 pandemic. The EDD’s failure to address red flags, implement reforms, and tackle online fraud has resulted in a dual crisis – massive fraud losses and financial instability for legitimate claimants. The mismanagement of the EDD has not only led to billions of dollars being distributed to fraudsters, but it has also left the UIF struggling to cover benefit payments amidst low unemployment rates. The table below highlights the current challenges faced by the UIF:

| Ongoing Challenges |

|---|

| Managing federal loans |

| Addressing mounting debt |

| Struggling to cover benefit payments |

The UIF’s ability to overcome these challenges will be crucial in restoring financial stability and ensuring that legitimate claimants receive the support they need. However, it will require significant reforms and a comprehensive approach to address the systemic issues that have plagued the EDD.

Also Read: California Mapping Out the Billionaire Backed Vision for a New City

Prospects and Projections: The Future of UIF’s Debt

Prospects for the future of the Unemployment Insurance Fund’s (UIF) debt remain uncertain as the California Employment Development Department (EDD) grapples with the aftermath of mismanagement during the COVID-19 pandemic. Here are four key factors that contribute to the uncertainty surrounding the future of UIF’s debt:

- Projected Debt: The UIF is projected to accumulate a debt of $21 billion by 2025, highlighting the urgency to address the issue promptly.

- Stalemate on Solutions: The EDD’s mismanagement has led to a divide between the union’s call for tax increases and the employer’s push for reforms, resulting in a stalemate that hinders progress in resolving the debt crisis.

- Financial Instability: The massive losses due to fraud and mishandled claims have created financial instability for legitimate claimants, further exacerbating the debt problem.

- Lack of Reforms: The EDD’s failure to address red flags, implement reforms, and tackle online fraud before the pandemic has contributed significantly to the current debt crisis, raising concerns about the department’s ability to prevent future debt accumulation.

Addressing these challenges is crucial to secure the future of the UIF and provide financial stability for both the fund and legitimate claimants.

EDD’s Lingering Challenges: Threats to California’s Unemployment System Stability

The lingering challenges faced by the California Employment Development Department (EDD) pose significant threats to the stability of California’s unemployment system.

The EDD’s mismanagement during the COVID-19 pandemic has led to a multitude of legitimate unemployment claims being mishandled, while billions of dollars were distributed to fraudsters. A Calmatters investigation has exposed the EDD’s failure to address red flags, implement reforms, and tackle online fraud before the pandemic.

This dual crisis of massive fraud losses and financial instability for legitimate claimants has highlighted the deep-rooted issues within the EDD.

The EDD’s inability to effectively handle unemployment claims and prevent fraud raises concerns about the long-term stability of California’s unemployment system. Without significant reforms and improved management, the EDD’s lingering challenges will continue to undermine the state’s ability to support its unemployed residents.

Conclusion Of California Multibillion Dollar Quandary

The mismanagement of the California Employment Development Department (EDD) during the COVID-19 pandemic has resulted in a dual crisis of fraud losses and financial instability for legitimate claimants.

The EDD’s failure to address red flags, implement reforms, and tackle online fraud before the pandemic has exacerbated the situation. This lack of proactive measures has allowed fraudulent activity to thrive, leading to significant financial losses for the state.

Moreover, the EDD’s struggles in managing the Unemployment Insurance Fund (UIF) have further compounded the problem. The fund has been depleted due to the combination of fraudulent claims and the sheer volume of legitimate claims during the pandemic. This has left the EDD in a precarious financial state, unable to meet its obligations to legitimate claimants.

As a result, the future stability of California’s unemployment system remains uncertain. The EDD’s inability to effectively address the fraud crisis and manage the UIF has created a sense of instability and uncertainty for those who rely on unemployment benefits.

Overall, urgent action is needed to address the mismanagement and restore confidence in the EDD’s ability to protect the integrity of the unemployment system. Without swift reforms and improved oversight, the dual crisis of fraud losses and financial instability will continue to plague California’s unemployment system.

Our Reader’s Queries

Q1. What is the problem with unemployment in California?

Ans. In the eyes of economists, the persistent underfunding or insolvency of California’s unemployment fund can be attributed to the long-standing stagnation of its taxable wage base. Additionally, the state’s continual expansion of benefits and eligibility criteria over the years without corresponding adjustments to the funding structure has further exacerbated this issue.

Q2. What to do when unemployment benefits are exhausted California 2023?

Ans. Individuals have the opportunity to reapply for unemployment benefits, granted they meet the necessary income criteria earned within the last 18 months and are currently either unemployed or working part-time. It’s important to note that processing new claims can typically take around two to three weeks.