California Shocking 68 Billion Dolloar Budget: In response to California’s staggering $68 billion budget crisis, the state finds itself at a pivotal juncture where critical decisions must be made to navigate the financial turmoil ahead.

With tax revenues plummeting, the revelation of a significant spending gap has sent shockwaves through the state’s economy and raised urgent concerns about sustainability.

The intricate web of factors contributing to this predicament unveils a complex landscape that California lawmakers must navigate with precision.

As the state grapples with revenue challenges and contemplates long-term implications, the path forward remains uncertain, demanding a strategic and prudent approach to address this pressing issue.

California’s Growing Financial Crisis

The State of California is currently facing a dire financial crisis, with recent reports indicating a staggering $68 billion budget gap, reflecting an alarming trend reminiscent of the Great Recession. The nonpartisan Legislative Analyst’s Office has highlighted the severity of the situation, projecting a shortfall that poses significant challenges for the state’s fiscal health. This budget deficit is a result of various factors, including a substantial drop in tax revenue and increased spending demands due to the ongoing public health crisis.

The unprecedented nature of this budget shortfall requires immediate attention and strategic planning from California lawmakers. Addressing such a massive gap will necessitate tough decisions regarding budget cuts, revenue generation, and potential restructuring of existing programs. Moreover, the long-term implications of this financial crisis could have far-reaching effects on the state’s economy, public services, and overall stability.

As California grapples with this growing financial crisis, proactive measures and prudent financial management will be crucial in navigating these challenging times and steering the state towards a more stable fiscal future.

Fiscal Challenges Ahead for California Lawmakers

California lawmakers are faced with impending fiscal challenges as they prepare to address the state’s significant budget deficit ahead of the upcoming fiscal year. The forecasted $68 billion budget crisis presents a daunting task for legislators who must navigate through complex financial decisions to stabilize the state’s finances.

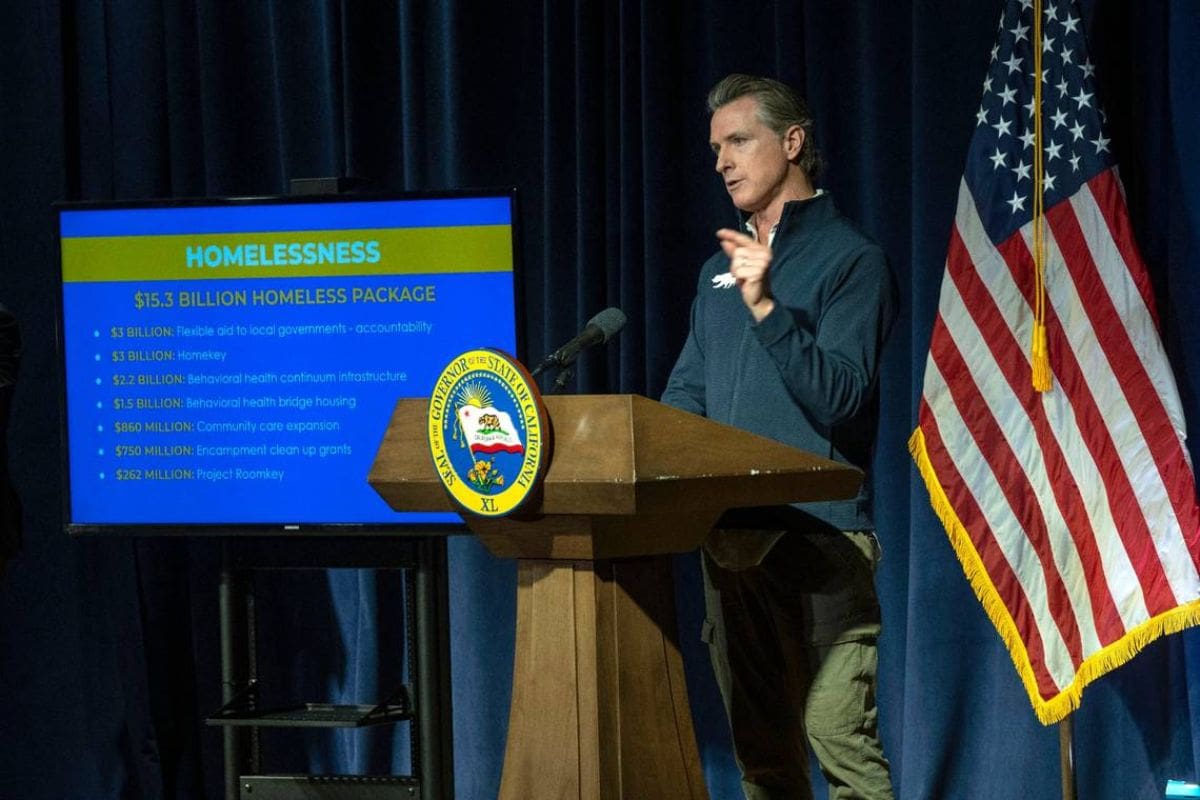

With Gov. Gavin Newsom set to unveil his proposed budget in early January, the pressure is heightened to find viable solutions to bridge the spending gap and ensure essential services are maintained. The looming deficit underscores the need for decisive action to address revenue shortfalls and escalating expenditure demands.

Lawmakers are tasked with balancing competing priorities, such as education, healthcare, and infrastructure, while also addressing the economic fallout from the ongoing pandemic. Collaborative efforts and strategic planning will be crucial in charting a sustainable path forward that safeguards California’s fiscal health and promotes long-term economic stability.

As the budget negotiations unfold in Sacramento, adept financial management and prudent decision-making will be imperative to mitigate the state’s financial challenges effectively.

Factors Contributing to the Budget Gap

An examination of the factors contributing to the budget gap in California reveals intricate complexities stemming from an unprecedented revenue decline in the fiscal year 2022-23, significantly impacting the state’s financial outlook. The revenue fell $26 billion below estimates due to tax filing deadline extensions caused by severe winter storms, as reported by the LAO. This unexpected shortfall disrupted the usual process where the Legislature has a clear view of the previous year’s revenue while crafting the new budget, creating a substantial gap in understanding and planning.

| Factors Contributing to Budget Gap | Impact |

|---|---|

| Unprecedented Revenue Decline | $26 billion below estimates |

| Tax Filing Deadline Extensions | Disrupted budget planning process |

| Lack of Clear Revenue Picture | Hindered budget shaping for the year |

The confluence of these elements has left California facing a daunting challenge in reconciling its budgetary discrepancies and charting a sustainable financial course forward. Addressing these issues will require strategic planning and decisive action to mitigate the impact of the revenue shortfall on the state’s fiscal health.

Addressing the Budget Gap

Given the significant budget deficit facing California, crucial decisions must be made promptly to address the financial shortfall and ensure the state’s fiscal stability moving forward. The Legislature will have several options to consider in tackling this $68 billion deficit:

- Withdraw Cash Reserves: Lawmakers could opt to withdraw up to $24 billion from cash reserves to help cover the budget gap.

- Reduce School Spending: Another strategy could involve lowering school spending to the legal minimum, potentially cutting general fund costs by $16.7 billion.

- Explore Additional Measures: In addition to the above options, further measures such as revising spending priorities, examining tax policies, or implementing efficiency measures may need to be explored to address the remaining deficit effectively.

It is imperative for California to carefully evaluate these options and potentially implement a combination of strategies to mitigate the budget crisis and safeguard the state’s financial well-being in the long term.

Revenue Challenges and Long-Term Implications

In light of the significant revenue challenges faced by the state, an in-depth analysis of California’s tax collections and the implications of declining revenue trends is imperative for understanding the long-term financial outlook. California’s struggle to raise additional revenue is evident, with the state ranking third highest in per capita tax collections according to a study by the Tax Foundation.

The state’s reliance on high marginal income tax rates, particularly in conjunction with New York, has contributed to substantial revenue declines. Even prior to the recent fiscal outlook report, California had been experiencing slower revenue growth compared to the national average. This poses a considerable challenge for the state, as traditional methods of increasing revenue may not be readily available.

The long-term implications of these revenue challenges are concerning, as sustained revenue declines could lead to further budget deficits, impacting essential services and potentially necessitating difficult fiscal decisions in the future. California’s ability to address these revenue challenges will be crucial in shaping its financial stability and resilience moving forward.

Also Read: California Bold Mental Health Revolution: A Game-Changer Ahead?

News In Brief

California faces a daunting $68 billion budget crisis as tax revenues plummet, sending shockwaves through the state’s economy. Lawmakers are at a critical juncture, grappling with complex decisions to address the staggering spending gap. The nonpartisan Legislative Analyst’s Office reveals unprecedented revenue declines, exacerbated by disruptions in tax filing due to severe winter storms. Gov. Gavin Newsom’s proposed budget looms, demanding urgent solutions to stabilize finances.

Options include tapping into reserves and trimming school spending, but additional measures are needed to close the deficit. California’s reliance on high-income tax rates compounds the challenge, with revenue growth lagging behind the national average. As the state navigates this fiscal turmoil, strategic planning and collaborative efforts are essential to ensure long-term stability and economic resilience.

Our Reader’s Queries

Why does California have a 68 billion dollar deficit?

Last month, the California Legislative Analyst’s Office (LAO) attributed the substantial budget shortfall primarily to a “severe decline in revenue.

What is the budget gap in California?

In today’s update, the Legislative Analyst’s Office revised the projected shortfall to $73 billion, marking a significant increase of $15 billion. The initial deficit estimate for the 2024-25 fiscal year stood at $58 billion in January, based on Governor Newsom’s revenue projections from his initial budget proposal of $292 billion.

How much is California’s budget shortfall?

In the July 2022 to June 2025 budget window, Governor Newsom’s presented budget on January 10 anticipates a $38 billion shortfall. Contrarily, the measures proposed by the governor to address the deficit amount to $58 billion, as outlined by the LAO.