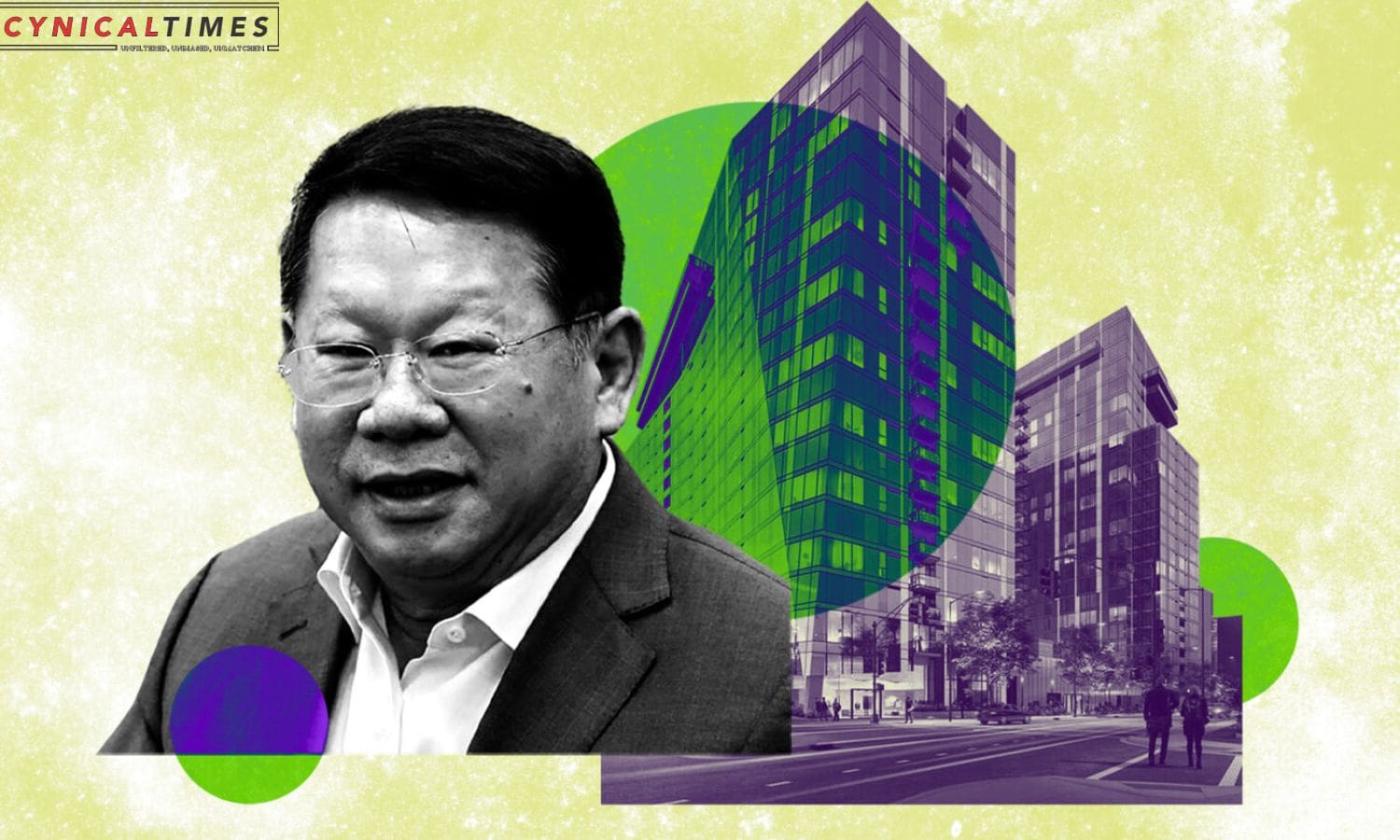

Z and L Properties Towering Troubles: Z&L Properties, a development company ensnared in a San Francisco corruption scandal, is facing significant challenges related to its twin-tower complex in Downtown San Jose. The firm, owned by the disgraced Chinese developer Zhang Li, is on the brink of defaulting on unsold condos at 188 West St. James Street. This precarious situation stems from Z&L’s failure to pay homeowner association (HOA) dues for completed but unsold units, risking foreclosure.

The background of Z&L’s troubles includes its involvement in a bribery scandal that resulted in the imprisonment of Mohammed Nuru, the former head of San Francisco’s Public Works Department. This scandal led to project delays across the Bay Area, including the 640-unit double highrise on St. James Street. While the west tower was completed and individual condos were listed for over $500,000 each, the total value of unsold condos reached $300 million.

Z&L is obligated to pay HOA dues for completed units, even if they remain unsold. However, the company’s failure to fulfill this financial responsibility has resulted in delinquency on at least 10 condos in the western tower. Notices of default have been filed by the 188 West St. James Owners Association, and the threat of foreclosure looms over the development.

Also Read: Housing Hopes and Auld Lang Syne: Navigating the Journey into 2024

The east tower of the complex remains vacant, adding to the challenges faced by Z&L Properties. The failure to resolve HOA payments has raised concerns, particularly voiced by Bob Staedler, a principal executive with Silicon Valley Synergy, who finds it “mind-boggling” that Z&L has not addressed the HOA payment issue.

County property documents reveal the extent of Z&L’s financial troubles, with the company in delinquency on multiple condos, facing potential foreclosure. Additionally, Z&L Properties has reportedly failed to pay numerous subcontractors for construction work at the condominium highrises. Subcontractors have responded by filing mechanic’s liens against the property. If these issues remain unresolved, subcontractors could move forward with foreclosure actions.

The situation is complex, involving not just financial challenges but also legal and contractual issues. The risk of foreclosure and the impact on homeowners, subcontractors, and the broader real estate market underscore the broader implications of Z&L Properties’ precarious position.